The difference lies in the recognition period. Likewise, a business can experience negative cash flow but still be profitable. Conversely, positive cash flow is when a company has more monies coming in than going out.Ĭompanies can have positive cash flow while being unprofitable. Profit is the revenue remaining after all expenses have been deducted.

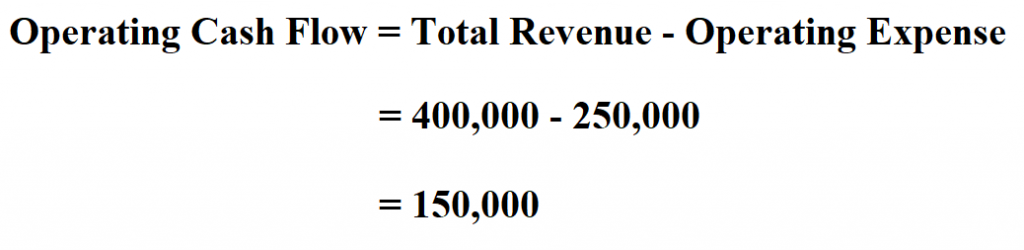

Yet, not all negative cash flows are bad.įor example, when investing in fixed or non-current assets, the company does not receive proceeds immediately.Ĭash outflow today can help companies gain a greater cash inflow in the future, making the negative cash balance a sign of future revenue.Īlthough the two measures may appear very similar, they are highly distinctive from each other. Thus, the company’s net cash flow is negative.Ĭheck the illustration below for a calculation breakdown. Negative cash flow stalls the business from paying for current and future expenses.įor example, a business starts with $50,000Ĭash inflow is $95,000 but cash outflow is $158,000.

In contrast, negative cash flow is when cash outflow exceeds cash inflow. Refer to the illustration below for a better understanding of the flow. It incurs $63,000 in expenses, but $117,000 of cash inflow enters the business (from various sources). Thus, the business has enough liquidity (cash) to pay the expenses.įor example, a business starts with $50,000 in cash. Positive Cash FlowĪ company has a positive cash flow if the cash inflow is greater than its cash outflow. It is important for businesses to understand the impact of positive and negative cash flows to determine and analyse cash flow forecasts thoroughly. A company’s cash flow can be positive or negative depending on it cash outflows and inflows.

0 kommentar(er)

0 kommentar(er)